Procedural aspects of 2020 AGM Extension

Provisions under the Companies Act pertaining to AGM’s

According to Section 96 of the Companies Act, 2013, every company other than a One Person Company shall in each year hold in addition to any other meetings, a general meeting as its annual general meeting. Not more than 15 months shall elapse between the date of one annual general meeting of a company and that the next.

In case of the first annual general meeting, it shall be held within 9 months from the date of closing of the first financial year of the company. In any other case annual general meeting shall be held within 6 months from the date of closing of the financial year.

The Registrar may, for any special reason, extend the time within which any annual general meeting, other than the first annual general meeting, shall be held, by a period not exceeding 3 months.

Illustrative reasons for extension of AGM are:

- Delay in finalizing the year end Financials

- Delay in audit reports due to non-availability of auditors because of resignation, death, incapacity to sign or such other valid reason

- Loss of data in computer due to virus/system problem

- Natural Calamity/Act of God or any other pandemic

- Change in financial year

- Non availability of shareholders which may result in absence of quorum

- Non-availability of directors on the valid grounds. For instance, sudden death of Directors and consequence of this the limit of directors goes below the minimum requirements of directors.

- Confiscation of Books of accounts by Income Tax Department, Serious and Fraud Investigation Cell or any other Government officials.

Attachments to E Form GNL 1:

- Detailed application

- General profile and history of the company containing details such as name, date of incorporation, main objects of the company

- Facts of the case mentioning nature of offence and period of default, if any

- Reasons of extension

- Period for which extension is required (Note: It should not exceed three months)

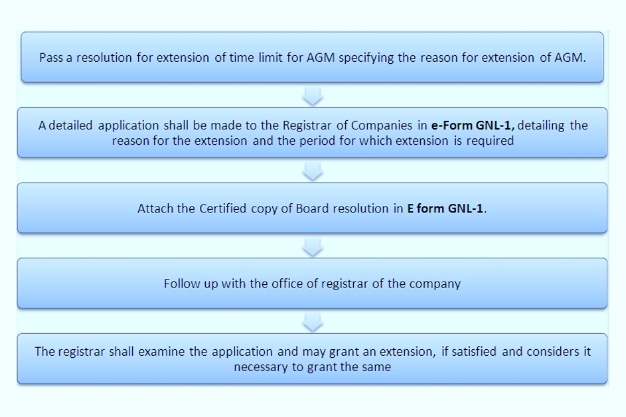

Procedure to seek an extension of 2020 AGM

Effects of grant of extension

Once the extension is being granted, the company may convene the Annual General Meeting of the Company within the period as allowed by the Registrar of Companies. Extension can be granted only once in a Financial Year as the Act does not allow Registrar of Companies to give further extension.

Extension of AGM to Companies having their F.Y. ending 31st March

The companies having their financial year ending on 31st March 2020 were required to hold their Annual General Meeting within six months, i.e. 30th September 2020. However, due to Covid-19, the companies were facing difficulty to hold the meeting in a stipulated time. Hence the Ministry of Corporate Affairs has issued a general circular No. 28/2020 dated 17th August 2020 has not given any extension to hold the annual general meeting. The said statutory period of Six Months has not been extended as expected from many quarters on the line of extension of the annual general meeting for such companies having closure their financial year 31st December 2019. Rather, have given weightage to their circular regarding holding of AGM through video conferencing (V.C.) or other audio-visual means (OAVM) for the calendar year 2020.

In view of the above discussions, It is once again reiterated that the companies which are unable to hold their AGM for the financial year ended on 31.03.2020, despite availing the relaxations provided in the G.C. 20/2020 ought to file their applications in form No. GNL-1 for seeking extension of time in holding of AGM for the financial year ended on 31.03.2020 with the concerned Registrar of Companies on or before 29.09.2020.

Consequences of failing to hold AGM in time

As per section 99 of the Act, a provision of punishment for not holding AGM in mention, if any default is made in complying or holding AGM of the Company, the Company and every officer of the Company who is in default shall be punishable with fine which may extend to ` 1 lakh and in case of continuing default, with a further fine which may extend to ` 5,000 for each day during which such default continues.